Taxpayers with an afs may use this safe harbor to deduct amounts paid for purchases and or improvements of tangible property for up to 5 000 per invoice or item provided that this.

Minimis safe harbor roof replacement.

Tax court in a tax year beginning after dec.

You do have an option of using the safe harbor election if you qualify.

The amounts allowable under the de minimis safe harbor are 2 500 or 5 000 depending on whether the taxpayer has an applicable financial statement afs.

1 a safe harbor for small invoices.

All expenses you deduct using the de minimis safe harbor must be counted toward the annual limit for using the safe harbor for small taxpayers the lesser of 2 of the rental s cost or 10 000.

The new tangible property regulations in effect for 2014 and later years mostly frustrate tax accountants and mostly confuse small businesses and real estate investors.

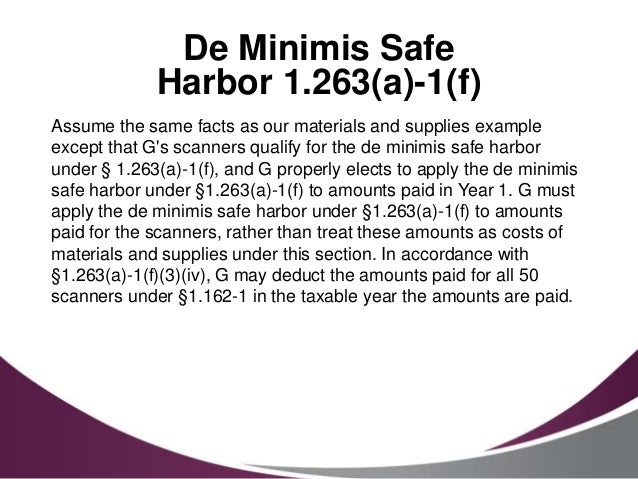

If you elect to use the de minimis safe harbor you don t have to capitalize the cost of qualifying de minimis acquisitions or improvements.

However for most landlords this safe harbor is limited to items that cost no more than 2 500 a piece.

The de minimis safe harbor election eliminates the burden of determining whether every small dollar expenditure for the acquisition or production of property is properly deductible or capitalizable.

A business with an applicable financial statement however has a safe harbor amount of 5 000.

A person or business can immediately deduct repair and maintenance expenses if the cost is 2 500 or less per item or per invoice.

If you determine that your cost was for an improvement to a building or equipment you still may be able to deduct your cost under the routine maintenance safe harbor.

Safe harbor for routine maintenance.

This increase is effective for costs incurred during tax years beginning on or after jan.

1 2016 but use of the new threshold won t be challenged in tax years prior to 2016 and if a taxpayer s use of the de minimis safe harbor is an issue under consideration in examination appeals or before the u s.

But in spite of this understandable frustration and confusion the new regulations provide one noteworthy loophole that both tax accountants and taxpayers need and will want to understand.

A taxpayer may elect a de minimis safe harbor to deduct the amounts paid to acquire or produce tangible property up to a dollar threshold.

Using the deduction under the de minimis safe harbor election is definitely the best option.

This is up from 500 which was the threshold through december 31 2015.

There is another alternative to the routine maintenance safe harbor.

De minimis safe harbor election.

For the latest irs rules on repairs and improvements see the irs online guide tangible property regulations frequently asked questions.

This expense is a capital improvement which makes the decision and the calculation a bit more complicated.